In the rapidly evolving world of cryptocurrencies, building your own cryptocurrency exchange can be a highly profitable and fulfilling venture. With the increasing popularity of digital currencies, the demand for reliable and user-friendly exchanges continues to soar. If you’re considering venturing into the realm of cryptocurrency exchange development in 2023, this article presents ten essential steps to guide you through the process.

Conduct Comprehensive Market Research

Before embarking on the development journey, it is crucial to conduct thorough market research. Analyze existing cryptocurrency exchanges, identify their strengths and weaknesses, and gain insights into the needs and preferences of your target audience. This research will help you refine your business model and establish a unique positioning within the market.

Define Your Unique Value Proposition

To succeed in the competitive cryptocurrency exchange landscape, it is vital to define a compelling unique value proposition. Determine the key differentiators that set your exchange apart from others. This could include offering low transaction fees, supporting a wide range of cryptocurrencies, providing advanced security features, or delivering an exceptional user experience. Clearly articulating your unique value proposition will enable you to stand out and attract users.

Ensure Compliance with Legal and Regulatory Requirements

The establishment of a cryptocurrency exchange necessitates navigating complex legal and regulatory frameworks. Thoroughly research the applicable laws and regulations in your target jurisdictions and ensure that your exchange adheres to all necessary requirements. This includes obtaining the required licenses, implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, and complying with data protection and privacy regulations.

Develop a Secure Infrastructure

Security is of utmost importance when dealing with cryptocurrencies. Build a robust and secure infrastructure that safeguards the assets and information of your users. Implement industry-standard security protocols such as encryption, multi-factor authentication, and offline cold storage for storing users’ funds. Conduct regular security audits and stay up-to-date with the latest security practices to mitigate potential threats.

Select a Reliable Technology Stack

Choosing the right technology stack is critical for the success of your cryptocurrency exchange. Opt for a scalable, high-performance platform capable of handling a large volume of transactions. Consider leveraging blockchain technology to ensure transparency and immutability. Additionally, integrate third-party APIs for liquidity, trading charts, and other essential functionalities.

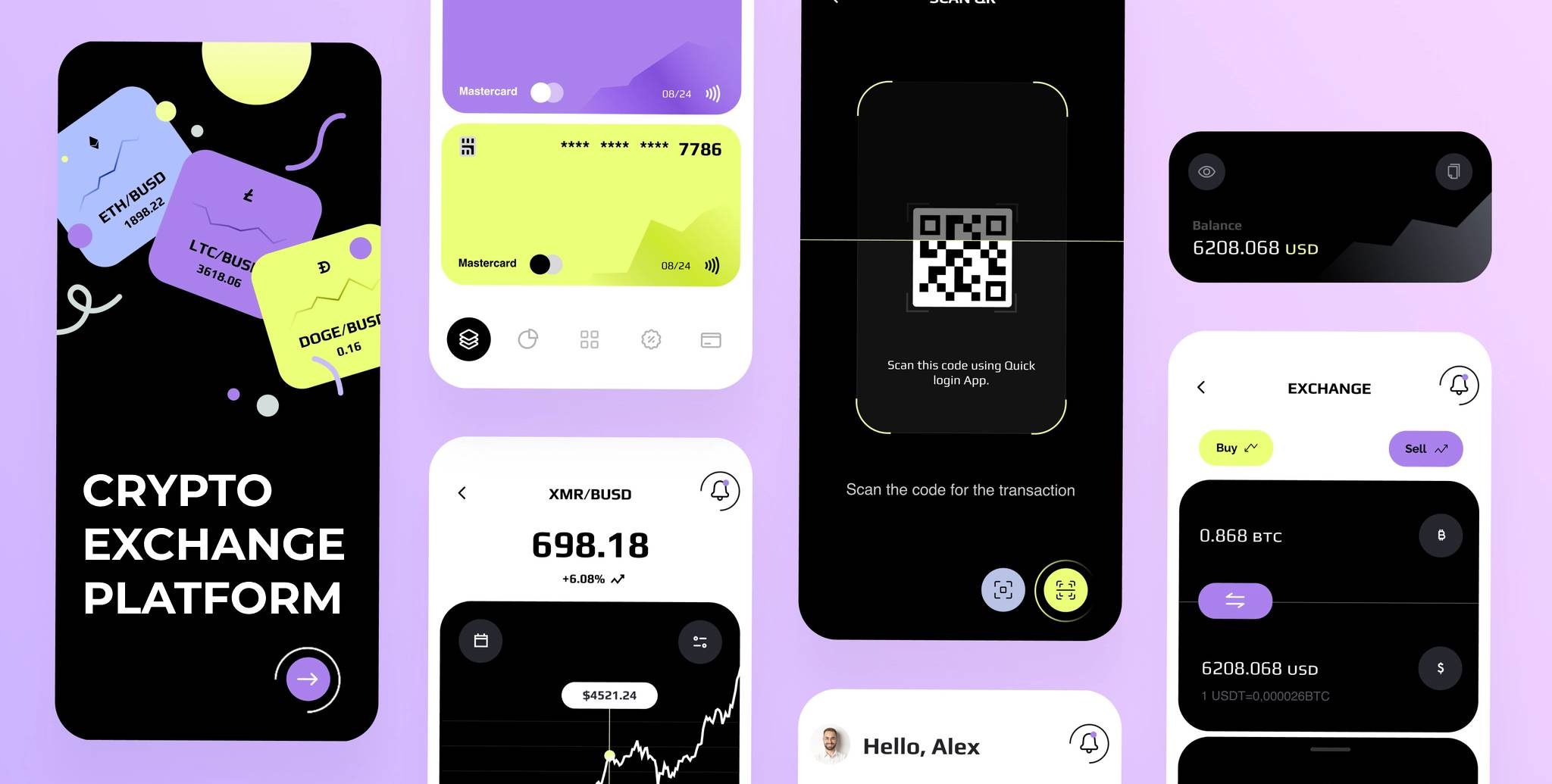

Design an Intuitive User Interface

A seamless user experience plays a pivotal role in attracting and retaining users on your cryptocurrency exchange. Create a clean and intuitive user interface that simplifies the trading process. Ensure smooth navigation, clear transactional workflows, and comprehensive account management features. Employ responsive design principles to optimize the user experience across different devices.

Implement a Trading Engine and Order Matching System

The trading engine serves as the backbone of a cryptocurrency exchange. Develop a robust trading engine that enables fast and accurate order matching. Implement various order types, including market orders, limit orders, and stop orders, to accommodate different trading strategies. Test and optimize the performance of your trading engine to handle high transaction volumes and maintain stability during peak trading periods.

Integrate Payment Gateways and Wallets

To facilitate seamless transactions, integrate reliable payment gateways that support a variety of fiat currencies and cryptocurrencies. Offer multiple deposit and withdrawal options, including bank transfers, credit/debit cards, and popular digital wallets. Implement secure and user-friendly wallets for storing and managing cryptocurrencies within your exchange.

Conduct Rigorous Testing and Quality Assurance

Thorough testing and quality assurance are imperative to ensure a smooth and bug-free user experience. Test all functionalities of your cryptocurrency exchange, including trading, deposits, withdrawals, and account management. Perform stress testing to assess the system’s performance under high loads. Engage beta testers to gather feedback and make necessary improvements before launching your exchange.

Launch and Continuously Improve

Once your cryptocurrency exchange has undergone comprehensive testing and is ready, it’s time to launch it to the public. Develop a comprehensive marketing strategy to attract users and build liquidity on your platform. Continuously monitor user feedback, analyze data, and strive to improve your exchange based on user needs and market trends. Stay updated with the latest developments in the cryptocurrency industry and adapt your exchange accordingly.

Conclusion

Building a cryptocurrency exchange in 2023 requires meticulous planning, diligent execution, and a steadfast focus on security, usability, and compliance. By following these ten steps and leveraging the right technologies, you can establish a successful cryptocurrency exchange that caters to the needs of traders and investors in the ever-expanding digital currency ecosystem.