What is digital banking?

Digital banking entails conducting banking activities through digital core banking platforms, reducing or eliminating reliance on traditional banking methods. Leveraging the latest technologies, digital banking streamlines and optimizes all banking processes and transactions.

Moreover, digital banking represents the comprehensive digitization of banking operations, incorporating artificial intelligence (AI) to simplify and automate various processes across the entire spectrum of digital banks.

From the customer’s perspective, digital banking involves utilizing banking services through devices such as laptops, smartphones, tablets, and other internet-connected hardware.

Key statistics of digital banking

The global digital banking user base is projected to reach 3.6 billion people by 2024, indicating that over half of the world’s population will engage with this advanced form of banking in just a few years.

Additional key statistics include:

- The first fully digital bank, Security First Network Bank, commenced operations online in 1995.

- Over 94% of mobile banking customers utilize digitals services at least once per month.

- Banking apps serve as the primary method for 4 out of 10 customers.

- Digital banking is the preferred choice for 25% of customers compared to in-branch banking.

- Almost 83% of customers are unlikely to switch banks due to digitals banking.

Digital banking services

Digital banking services encompass a wide range of popular banking activities:

- Opening and managing multi-currency accounts

- Requesting and replacing payment cards

- Making payments, handling bill payments, and conducting transfers

- Viewing bank statements and reports

- Opening deposit accounts

- Withdrawing cash

- Currency exchange

- Generating IBANs

Digital Banking Solutions

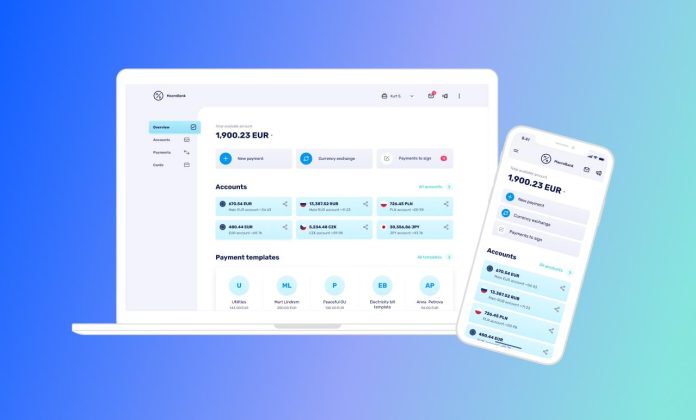

To deliver a competitive, secure, and distinctive user experience, platforms like Advapay’s Macrobank offer advanced digitals banking solutions. These solutions go beyond being mere online banking platforms, serving as tools that differentiate financial organizations or banks based on the level of service they provide.

Digitals banking solutions enable modern financial organizations and banks to achieve their business goals through readily available functionality. As the organization grows, additional functions can be seamlessly added over time, providing significant business value without hidden costs.

Key Features of Digital Banking Solutions

- Ready-to-use and customizable complete back-office platforms with essential functionalities.

- Ready mobile and web banking apps for end-users, supporting cross-platform compatibility for all browsers and iOS/Android apps.

- Out-of-the-box integration with APIs to reduce risks related to upgradability and testability.

- Cloud-ready microservices architecture ensuring scalability, stability, and portability.

Benefits of Ready Digital Banking Solutions

- Faster market launch of products and services compared to a bank’s own development process, which typically takes at least a year for software development from scratch.

- Seamless integration of external and internal systems, with ready digitals banking solutions offering a range of ready-to-use integrations.

- Quick customization of a ready-made modern system with branding, as opposed to the time-consuming process of developing solutions from scratch.

- Rapid go-live with minimal risk, avoiding delays and uncertainties associated with in-house development, such as the risk of losing skills and going over budget.

- Efficient budget management, creating products within financial constraints, which is more effective than in-house development of digitals banking solutions.

Choosing the Right Digital Banking Software

Selecting the ideal digital banking software for your business involves careful consideration of various factors. Here’s a breakdown of key considerations to guide your decision-making process.

Also read: A Comprehensive Overview The Lido Quiz Answers on cointips.info

Align functionality with your business plan

Start by developing a comprehensive business plan and services overview. Define the payment types, currency pairs, and countries your business will operate in to determine the necessary functionality. A robust core banking solution should encompass essential features such as:

- Multi-currency accounts and IBAN generation

- Diverse payment methods

- KYC/AML and customer onboarding

- Financial accounting and general ledger

- Workflow management

- Currency exchange

- Card issuance

Additionally, ensure that the chosen digitals banking system provides ready-to-use web banking and mobile applications that can be tailored to your specific requirements.

Evaluate total costs

Consider various factors when calculating the total costs associated with the digitals banking solution:

- Software purchase

- Setup costs

- Monthly and maintenance fees

- Integration expenses

- System hosting and software updates

Choose a solution that aligns with your budget constraints and provides transparent cost structures.

Assess technical and security requirements

Integrations and APIs:

Ensure that the core banking system supports an “open banking” approach by utilizing open APIs for seamless integration with payment services providers and other third-party entities, such as AML/KYC providers for efficient client registration and onboarding.

Architecture and flexibility:

A digitals banking back-office application should exhibit flexibility to accommodate future changes in regulatory requirements and evolving customer needs. The system must be adaptable to modifications in workflows, addition of new products, increased payment volumes, and other business adjustments.

End-user app customization:

The mobile and web banking applications should be easily customizable, meeting both branding requirements and specific business needs. Digitals banking staff should have the capability to make routine changes, such as adding or deleting fields for client registration, adjusting operational workflows, and implementing other modifications essential for daily operations.

Wow, incredible blog layout! How long have you been running a blog for?

you make blogging glance easy. The total look

of your website is excellent, let alone the content! You

can see similar: e-commerce

and here sklep online

very informative articles or reviews at this time.